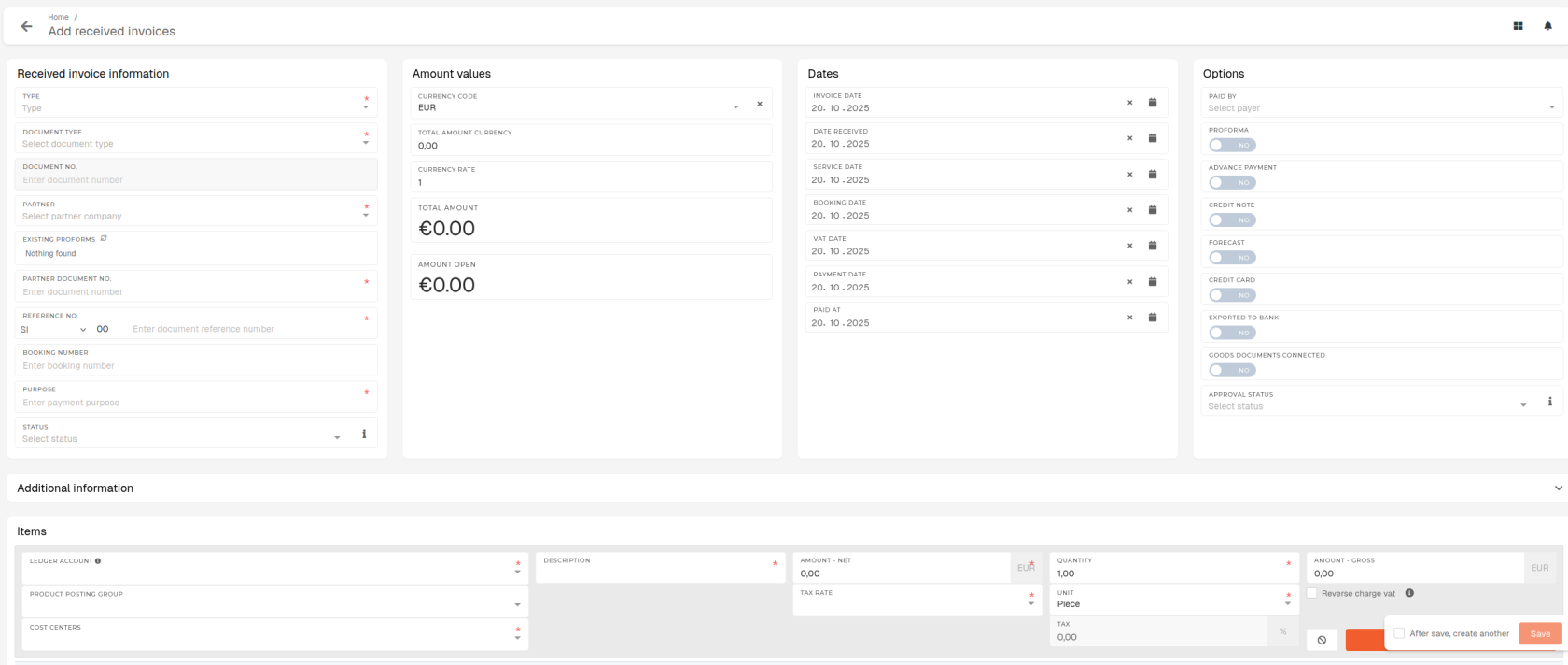

Creating Invoices received

This guide explains how to correctly fill out each field in the “Add Received Invoices” form.

Prerequisite requirements

Partner company must issue the invoice. The invoice and the leader accounts must already be created in the ERP.

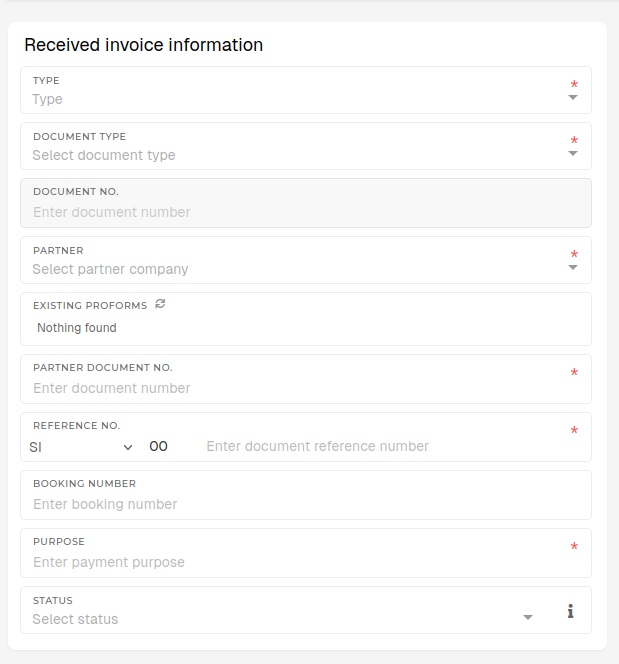

Received Invoice Information

Type

Select the invoice type (e.g., Purchase Invoice, Expense Invoice). This field is required.

Document Type

Choose the type of document (e.g. Invoice, Credit Note,...). This field is required.

Partner

Select the supplier or partner company issuing the invoice. Selected partner must already exist in ERP under the "Partners" section. This field is required.

Partner Document No.

Internal reference or invoice number from supplier (if different). This field is required.

Reference No.

Internal reference number for the invoice, used by your organization. This field is required.

Purpose

State the purpose of the payment (e.g., “Office Supplies”, “Consulting Fees”,...). This field is required.

Status

Choose the current document status (e.g., New, Paid,...).

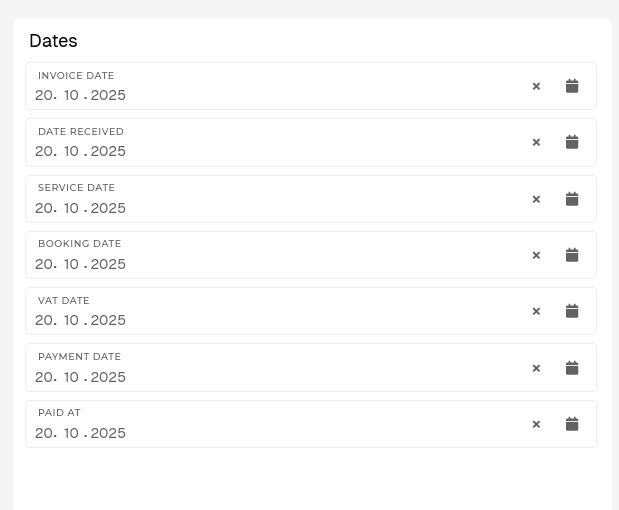

Dates

Enter the appropriate dates using the calendar picker.

Invoice Date

Date printed on the supplier’s invoice.

Date Received

Date your organization received the invoice.

Service Date

Date when goods or services were provided.

Booking Date

Date when the invoice is entered in your accounting records.

VAT Date

Date used for VAT/tax reporting purposes.

Payment Date

Planned date for payment to the supplier.

Paid At

Actual date when payment was completed.

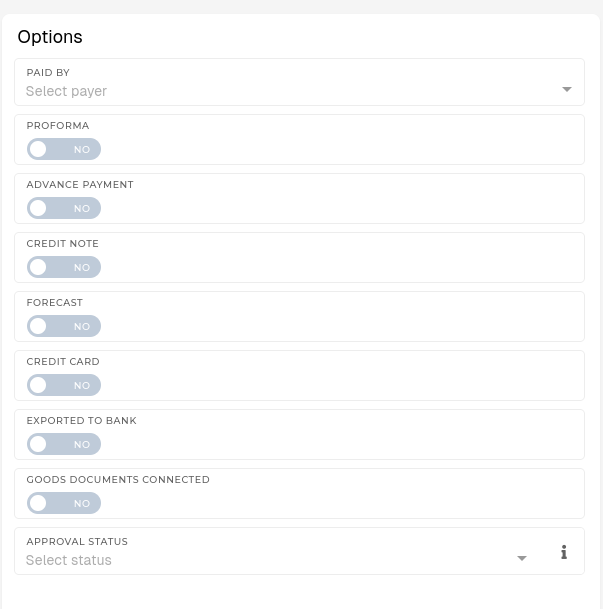

Options

These switches and dropdowns define additional attributes of the invoice.

Paid By

Select, who is paying the invoice (department, cost center or account).

Proforma

Toggle ON, if the document is a proforma invoice.

Advance Payment

Toggle ON, if this is a prepayment invoice.

Credit Note

Toggle ON, if the invoice is a credit note (reduces balance).

Forecast

Toggle ON, if this invoice is part of a forecast, not an actual invoice record.

Credit Card

Toggle ON, if payment was made via credit card.

Exported to Bank

Toggle ON, if when this invoice has already been exported to a banking software.

Goods Documents Connected

Toggle ON, if invoice is connected to a delivery note or goods receipt.

Approval Status

Select invoice's current approval stage (Pending, Approved, Rejected,...).

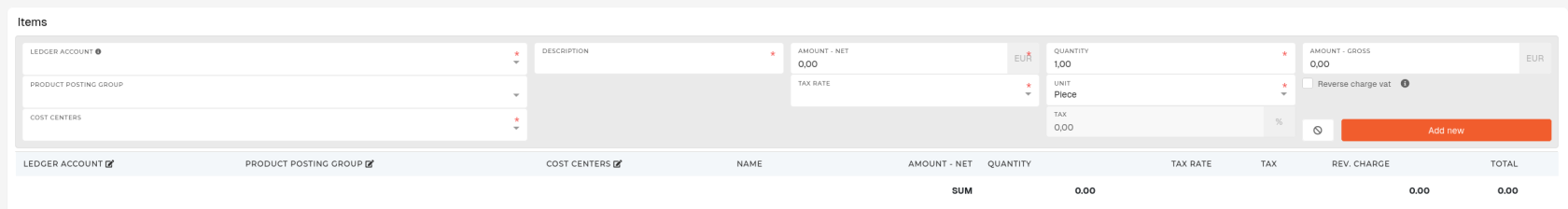

Adding Items

Each row represents one invoice line item. You can add multiple items per invoice. New line items can be added with the "Add New" button.

Ledger Account

Select the account where this cost will be booked. This field is required.

Product Posting Group

Choose the related product or service posting group.

Cost Centers

Assign the cost to a department, project or cost center.

Description

Describe the goods or services (e.g., “Printer Paper A4 500 sheets”). This field is required.

Amount – Net

Enter the net value (before tax). This field is required.Tax Rate (%)

Tax Rate (%)

Enter applicable TAX/VAT percentage. This field is required.

Quantity

Enter how many units were invoiced. This field is required.

Unit

Select the unit of measure (e.g., Piece, Hour, kg). This field is required.

Tax

Automatically calculated based on Amount – Net + Tax Rate values.

Amount – Gross

Enter the gross value (before tax). This field is required.

Reverse Charge VAT

Toggle this, if reverse charge rules apply for this invoice.

To book to specific campaign, the cost center must be set to that campaign.