Creating Invoices received

This guide explains how to correctly fill out each field in the “Add Received Invoices” form.

Prerequisite requirements

Partner company must issue the invoice. The invoice and the leader accounts must already be created in the ERP.

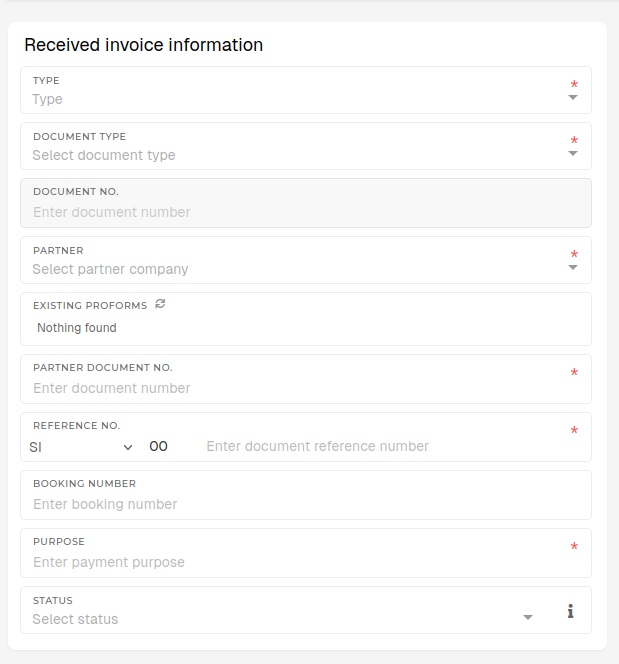

Received Invoice Information

Type

Select the invoice type (e.g., Purchase Invoice, Expense Invoice). This field is required.

Document Type

Choose the type of document (e.g. Invoice, Credit Note,...).

Partner

Select the supplier or partner company issuing the invoice. Selected partner must already exist in ERP under the "Partners"Partners" section.

Partner Document No.

Internal reference or invoice number from supplier (if different).

Reference No.

Internal reference number for the invoice, used by your organization.

Purpose

State the purpose of the payment (e.g., “Office Supplies”, “Consulting Fees”,...).

Status

Choose the current document status (e.g., New, Paid)Paid,...)

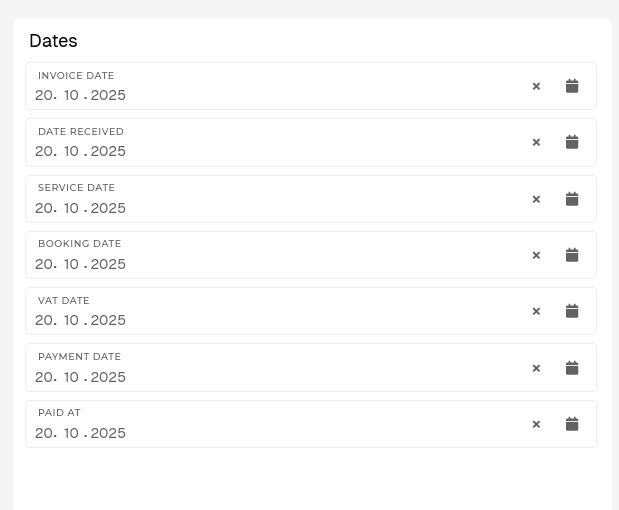

Dates

Enter the appropriate dates using the calendar picker.

Invoice Date

Date printed on the supplier’s invoice.

Date Received

Date your organization received the invoice.

Service Date

Date when goods or services were provided.

Booking Date

Date when the invoice is entered in your accounting records.

VAT Date

Date used for VAT/tax reporting purposes.

Payment Date

Planned date for payment to the supplier.

Paid At

Actual date when payment was completed.

Options

These switches and dropdowns define additional attributes of the invoice.

|

Option |

Description |

Type |

|---|---|---|

|

Paid By |

Select who paid (department, cost center, or account). |

Dropdown |

|

Proforma |

Toggle ON if the document is a proforma invoice. |

Switch |

|

Advance Payment |

ON if this is a prepayment invoice. |

Switch |

|

Credit Note |

ON if the invoice is a credit note (reduces balance). |

Switch |

|

Forecast |

ON if this invoice is part of a forecast, not an actual record. |

Switch |

|

Credit Card |

ON if payment was made via credit card. |

Switch |

|

Exported to Bank |

ON when this invoice has been exported to banking software. |

Switch |

|

Goods Documents Connected |

ON if connected to a delivery note or goods receipt. |

Switch |

|

Approval Status |

Select approval stage (Pending, Approved, Rejected). |

Dropdown |

Adding Items

Each row represents one invoice line item. You can add multiple items per invoice.

|

Field |

Description |

Required |

|---|---|---|

|

Ledger Account |

Select the account where this cost will be booked. |

✅ |

|

Product Posting Group |

Choose the related product or service posting group. |

❌ |

|

Cost Centers |

Assign the cost to a department, project, or cost center. |

❌ |

|

Description |

Describe the goods or services (e.g., “Printer Paper A4 500 sheets”). |

✅ |

|

Amount – Net |

Enter the net value (before tax). |

✅ |

|

Quantity |

Enter how many units were invoiced. |

✅ |

|

Unit |

Select the unit of measure (e.g., Piece, Hour, kg). |

✅ |

|

Tax Rate (%) |

Enter applicable tax/VAT percentage. |

✅ |

|

Amount – Gross |

Automatically calculated based on Net + Tax. |

— |

|

Reverse Charge VAT |

Tick this if reverse charge rules apply. |

Optional |

Click ➕ Add New to include additional line items.

To book to specific campaign, the cost center must be set to "campaign"